How income tax works. Including terms and my hand-drawn graphic.

Federal & State Income Tax

Our government needs money for roads, schools, and tons of other things. Part of the way we give it money is as a percentage of our income. Everyone in the United States is subject to the Federal Income Tax. Most states also have their own version of income tax that you pay on top of the Federal Income Tax.

They all follow the same basic model:

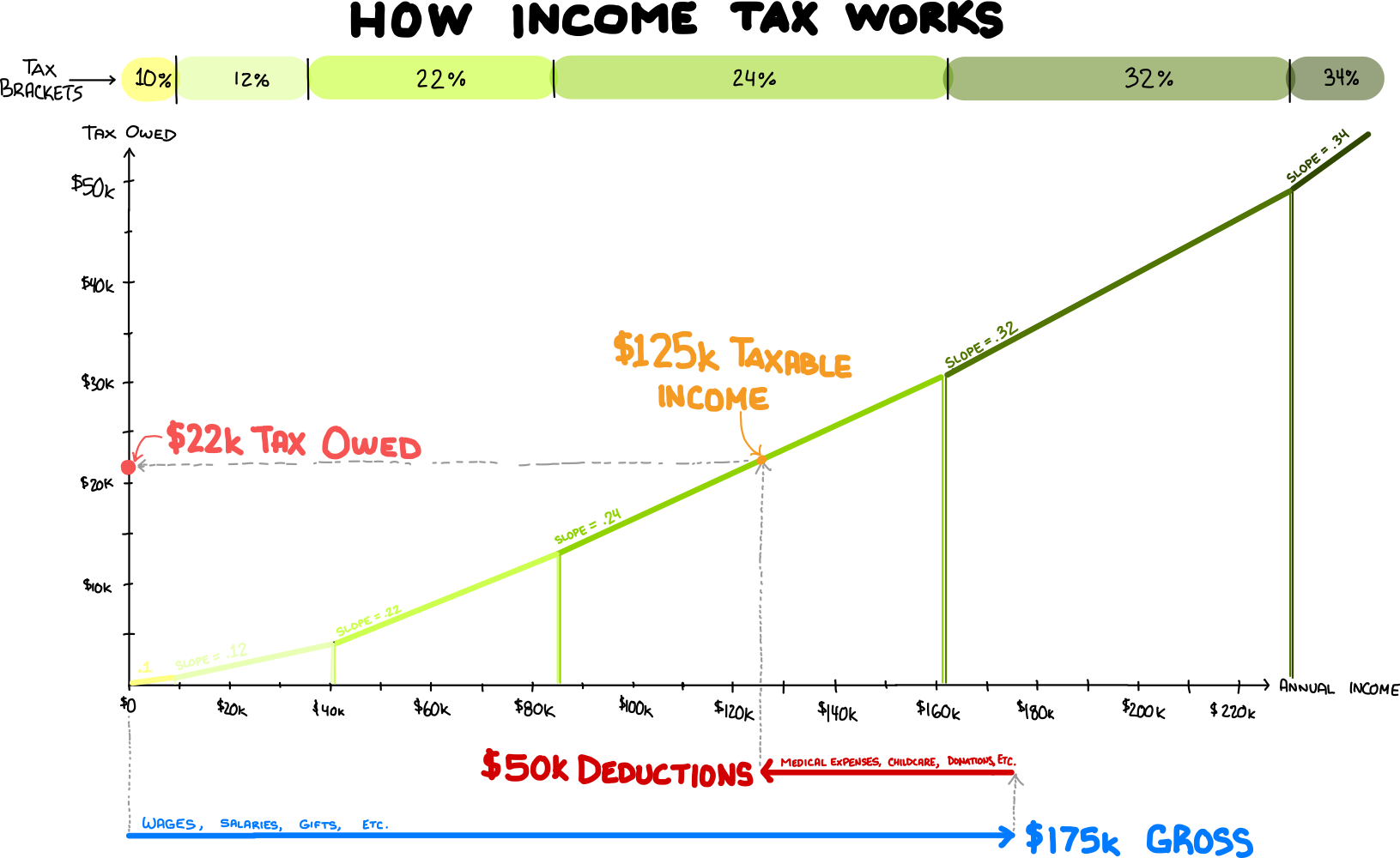

- All the money you make in a given year is your gross income.

- We decided some of the money you make shouldn’t count toward your income. These deductions are for expenses from things society values (e.g. health insurance, job seeking, charitable donations, and so on)

- Your gross income minus your deductions is your taxable income.

- Your taxes are where your taxable income means the TAX RATE LINE.

- The TAX RATE LINE is piecewise linear, broken into “tax brackets” with different slopes (tax rates).

- Law makers decide…

- Where the tax brackets begin and end

- What is the slope of the TAX RATE LINE in each bracket

- What kinds of expenses are deductible

- Rather than pay our income tax all at once, we guess what it will be for the whole year, then pay it a little bit at a time each paycheck.

- Once a year (before a deadline usually set mid-April), we check our guess, then a check is cut (either by you or the government) to correct for errors in the guess. This correction is called your “refund”.

Now, in actuality, there is way more details that go into all of this. There’s an entire industry of people whose full time jobs are to work out how this should be done and how to best help people do it. This, though, is a pretty decent cutoff point to claim basic understanding. Congratulations.

⬆️⬆️⬆️⬆️⬆️ this is all for Federal Income Tax - there are other Tax Types (most (/all?) of which behave the same)