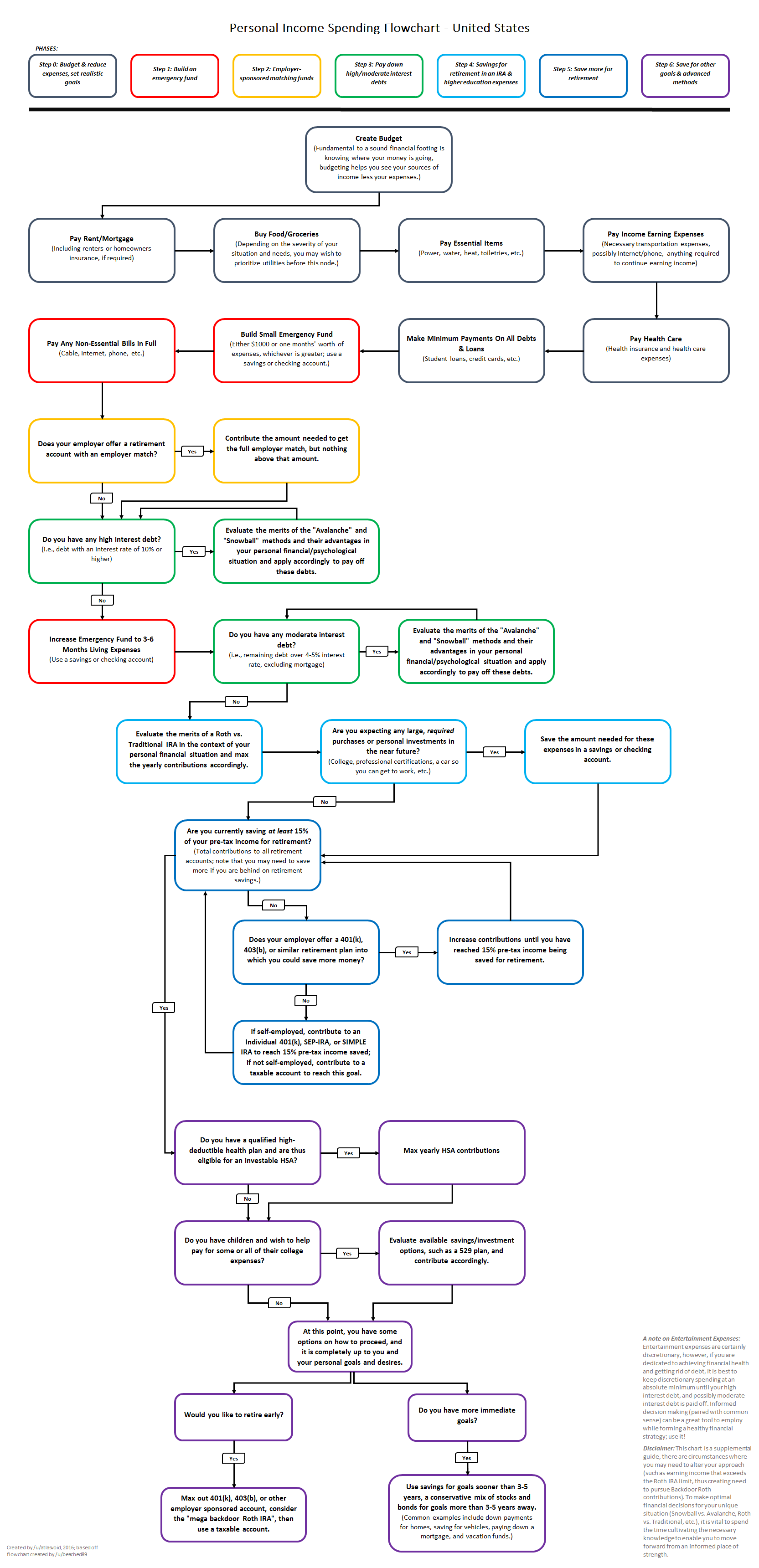

A great “order of precedence” guide from Reddit.

In non-flowchart form: (see full source)

Budget & Reduce Expenses

- create a Budget

- Pay housing

- Buy food

- Pay essential bills

- Pay income earning expenses

- Pay healthcare

- Make minimum payments on all debts

Build Emergency Fund

- Build small Emergency Fund

- Pay non-essential bills

Employer-Sponsored Matching Funds

- Contribute to get employer match

Pay High Interest Debts

- Pay high interest (>10%) debts

- Increase emergency fund

Save for Retirement/School

- Pay medium interest debts

- Fund at least 15% to Employer-Sponsored Savings Accounts

Max Saving Mode

- Max HSA

- Contribute to 529 Accounts

- Max Employer Sponsored accounts

- Or: put aside savings/stocks/bonds for anticipated big purchases

Source

How to prioritize spending your money - a flowchart (redesigned)